SBA suspends thousands of pandemic-era loans approved by Minnesota over potential fraud

Thousands of pandemic-era loans in Minnesota have been suspended for suspected fraud, U.S. Small Business Administration's Kelly Loeffler announced Thursday night.

Loeffler says 6,900 borrowers were suspended for 7,900 Paycheck Protection Program (PPP) and Economic Injury Disaster (EIDL) loans worth approximately $400 million.

"These individuals will be banned from all SBA loan programs, including disaster loans, going forward. We will also refer every case, where appropriate, to federal law enforcement for prosecution and repayment," Loeffler wrote in a post on X. "After years, the American people will finally begin to see the criminals who stole from law-abiding taxpayers held accountable - and this is just the first state."

Loeffler did not provide any additional details about the allegedly fraudulent loans.

Last week, Loeffler sent a letter to Minnesota Gov. Tim Walz stating that the Small Business Administration would be halting $5.5 million in annual funding to Minnesota "pending further review."

On Dec. 2, Loeffler announced she ordered a full investigation into "the network of Somali organizations and executives" implicated in pandemic-era fraud schemes in the North Star state.

The Small Business Administration's internal watchdog in June 2023 estimated that the agency disbursed over $200 billion in "potentially fraudulent" COVID-era EIDL and PPP loans. That's about 17% of the total funds that were disbursed under those programs during the pandemic

Under the Coronavirus Aid, Relief and Security Act, signed into law by President Trump in 2020, borrowers could self-certify that their loan applications were accurate. Stricter rules were put in place in 2021 to stem pandemic fraud, but "many of the improvements were made after much of the damage had already been done due to the lax internal control environment created at the onset of these programs," the SBA Office of Inspector General found.

Other allegations of fraud

Minnesota has recently been in the national spotlight over allegations of widespread fraud within the state's public assistance programs.

More than 90 people face federal charges as a result of what a top prosecutor in Minnesota said was "industrial-scale fraud." The prosecutor, Joe Thompson, said last month that the total amount of fraud in Minnesota could reach $9 billion billed across 14 Medicaid programs that have been deemed "high risk" for fraud. Walz and other state officials, however, have questioned that amount.

The scandal began when the nonprofit Feeding Our Future, which is based in Minnesota, was accused of stealing from the Federal Child Nutrition Program by falsely claiming to distribute meals during the COVID-19 pandemic. More than 75 people have been charged in the COVID-era fraud scheme, and at least 56 have pleaded guilty.

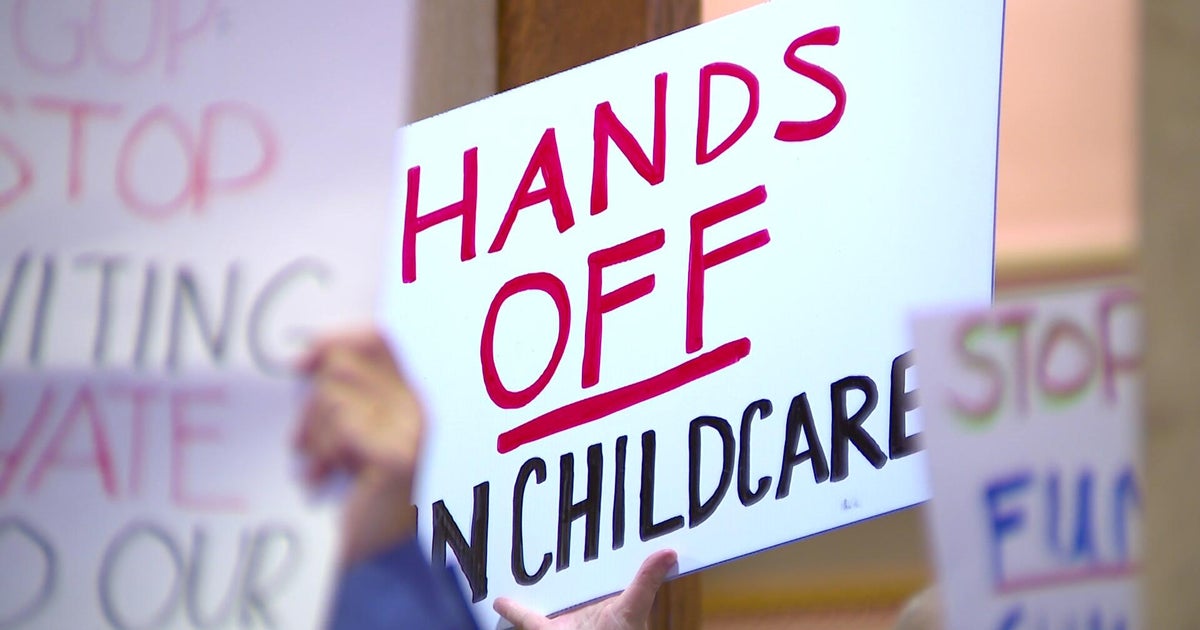

Since then, federal prosecutors have uncovered alleged fraud schemes involving a now-defunct housing stabilization program in Minnesota and a Medicaid-backed state program that provides services to children with autism. Homeland Security agents are also conducting investigations into child care centers in the state after a conservative YouTuber named Nick Shirley posted a video online over the weekend alleging that nearly a dozen centers that receive public dollars are not providing any services.

A CBS News analysis of the day care centers mentioned by Shirley found that all but two have active licenses, according to state records, and state regulators visited the active locations within the last six months. While the centers were cited for safety, cleanliness and other issues, there was no recorded evidence of fraud.

Still, in response to the allegations, the Department of Health and Human Services announced Tuesday that it has frozen federal child care payments for Minnesota.

The House Oversight and Government Reform Committee is set to hold a hearing next week on the alleged fraud schemes.