Former Minnesota Gov. Jesse Ventura launches cannabis edibles brand

Former Minnesota Gov. Jesse Ventura, who has been a strong supporter of cannabis legalization, is launching his own edible brand on 4/20.

Watch CBS News

Former Minnesota Gov. Jesse Ventura, who has been a strong supporter of cannabis legalization, is launching his own edible brand on 4/20.

You have no doubt heard this before: Supporters say this year could be the year that the Minnesota Legislature legalizes sports betting.

As Minneapolis prepares for Uber and Lyft to skip town, several City Council members are hoping more discussions can keep the companies from leaving.

The PIIC said Thursday Island Peži will open in the next few months "subject to obtaining all necessary Tribal licensure and approval."

Wisconsin Gov. Tony Evers has signed bipartisan bills designed to create a statewide electric vehicles charging network.

A new security measure is now in place at the Mall of America.

A controversial minimum wage ordinance that prompted Uber and Lyft to announce they will cease operating in Minneapolis in May could be up for reconsideration at the City Council.

Minnesota's minimum wage statewide would bump to $15 an hour starting this summer and increase each year until it reaches $20 under a plan that advanced in the state Senate on Tuesday.

Someone is set for a major payday after buying a lottery ticket in the small southern Minnesota city of Zumbro Falls.

With the country on the cusp of greeting the return of spring, a warm-weather treat is once again available for free for a limited time only.

A new bill that would increase Minnesota's minimum wage is making its way through the state legislature.

Rep. Elliott Engen of White Bear Lake is introducing a bill that would essentially override Minneapolis' ordinance and prevent any city or municipality from setting their own rules for rideshare driver pay.

Experts say home prices could come down since commissions are often baked into the price. Others are skeptical of the impact — saying if the sellers aren't paying the buyer's agents, the buyer would still have to.

Whether they were first time visitors or returning home from a long work trip, Uber and Lyft's threats to leave Minneapolis have left some travelers' future up in the air.

Meta, the parent company of Facebook announced plans to build a new data center in Rosemount, Minnesota.

Hennepin County Attorney Mary Moriarty said her office has received a "substantial" number of submissions to the evidence portal her office launched last week after the FBI took over sole authority of the investigation into the shooting death of Renee Nicole Good by a U.S. Immigration and Customs Enforcement officer.

With all the ICE activity happening in Minnesota, people are asking: Where are federal agents taking the people they detain? WCCO Investigates is digging in to share who's working with ICE and what we've learned.

"If you can't properly differentiate between a U.S. citizen and a foreign national, you need to be in a different position," Eric O'Denius said.

The UDA College Nationals, dubbed "the Super Bowl of dance," is this weekend in Orlando. And for the second year in a row, WCCO has exclusive coverage of the competition, which features the University of Minnesota's dance team.

Plaintiffs' attorneys are asking a federal judge to intervene after three Democratic members of Congress were blocked from visiting an Immigration and Customs Enforcement facility in Minnesota over the weekend.

With all the ICE activity happening in Minnesota, people are asking: Where are federal agents taking the people they detain? WCCO Investigates is digging in to share who's working with ICE and what we've learned.

The sound of whistles and shouting drew attention to a mall at Third Street and 33rd Avenue in St. Cloud, Minnesota, on Monday.

Best of the Best showcase brings together college and high school dance teams from Minnesota and neighboring states to celebrate the sport, but also debut routines ready for UDA College Nationals in Orlando, Florida.

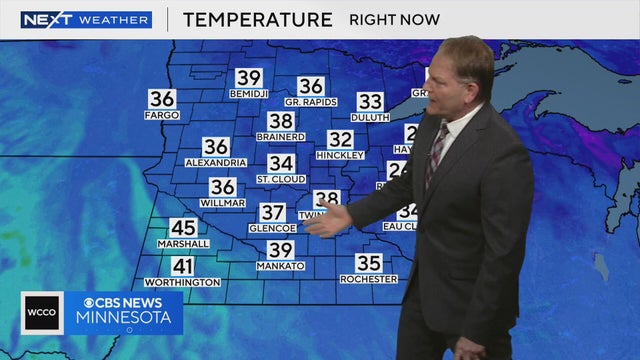

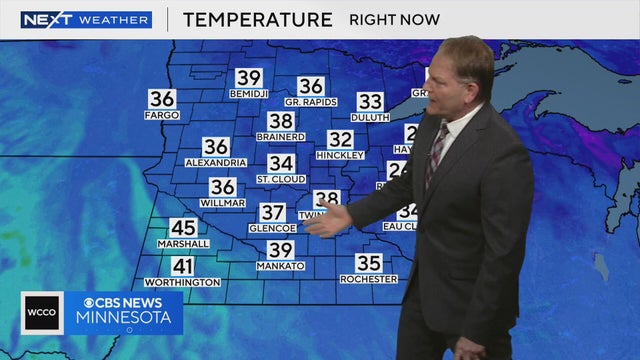

Minnesota's relatively mild run of weather will be briefly interrupted by some snow showers, gusty winds and frigid wind chills over the weekend.

Police in Moorhead, Minnesota, are asking for the public's help to find 17-year-old Neeshka Lafromboise, who has been missing since Monday.

A Wisconsin man accused of sending the state Supreme Court's chief justice intimidating emails has been sentenced to probation.

Some schools in Minnesota and Wisconsin are delayed or closed on Tuesday as early morning rain makes the roads slick.

A western Wisconsin town is reveling in the national spotlight.

When he's not playing zone or man, Hall is carving it up at local hills. He has qualified for multiple professional snowboard competitions.

Two people were killed and another hurt in a crash in western Wisconsin Tuesday afternoon.

Many people who serve in the U.S. military find it hard to ask for assistance when they've been trained to help and serve others.

Food Bank Eatery in North Minneapolis provides free meals for children, who may have little to eat after the pause of SNAP benefits for many in the community.

Firefighters are continuing a 44-year tradition that happens every year north of the Twin Cities.

It was a scary moment in the Twin Cities over the weekend, as a trailer hauling sled dogs turned over on Interstate 494 in Minnetonka.

On Sunday, members of Minnesota's Somali community spoke out against President Trump's social media post calling for an end to temporary protected status.

U.S. Immigration and Customs Enforcement is making arrests in Minnesota right next to shoppers grabbing groceries. Tense encounters are happening at private businesses. That has some people wondering what authority ICE agents have at places of business. WCCO Jeff Wagner gets answers from an immigration lawyer.

A legal battle has begun to try to force out federal agents out of Minnesota. The state, Minneapolis and St. Paul are working together to sue the Trump Administration. The next step could happen as soon as tomorrow. Minnesota is not the first state to fight back against federal enforcement. WCCO's Ashley Grams talked to an expert to find out whether this suit stands a chance.

Hennepin County Attorney Mary Moriarty said her office has received a "substantial" number of submissions to the evidence portal her office launched last week after the FBI took over sole authority of the investigation into the shooting death of Renee Nicole Good by a U.S. Immigration and Customs Enforcement officer.

On Monday afternoon, WCCO's Esme Murphy sat down with Bovino to discuss the ICE crackdown, the widespread backlash and what the future holds in the Twin Cities and beyond. Here is their full conversation.

With all the ICE activity happening in Minnesota, people are asking: Where are federal agents taking the people they detain? WCCO Investigates is digging in to share who's working with ICE and what we've learned.

It's a business model picking up steam across the Twin Cities. For instance, all the major sports venues in town, like Target Field and U.S. Bank Stadium, no longer accept cash.

WCCO gathered data on core staple items from Aldi in Apple Valley, Target in Fridley and Cub Foods in north Minneapolis.

Minnesota drivers have something to celebrate this holiday — a price drop at the pump.

With costs still high and budgets stretched, getting smarter with money matters more than ever.

There were 584 vehicles towed during this week's snow emergency in Minneapolis. That number stands at 352 and counting in St. Paul, where parking restrictions are in place until 9 p.m. on Friday, Jan. 2.

Hennepin County Attorney Mary Moriarty said her office has received a "substantial" number of submissions to the evidence portal her office launched last week after the FBI took over sole authority of the investigation into the shooting death of Renee Nicole Good by a U.S. Immigration and Customs Enforcement officer.

On Monday afternoon, WCCO's Esme Murphy sat down with Bovino to discuss the ICE crackdown, the widespread backlash and what the future holds in the Twin Cities and beyond. Here is their full conversation.

With all the ICE activity happening in Minnesota, people are asking: Where are federal agents taking the people they detain? WCCO Investigates is digging in to share who's working with ICE and what we've learned.

A large crowd gathered outside the Richfield Target over the weekend, just days after ICE agents took two employees into custody, as community members implore the corporation to speak out about what's happening in the Twin Cities.

The St. Anthony Police Department says officers were called to Equinox Apartments just after 5 a.m. for a reported stabbing.

The Minnesota Department of Employment and Economic Development says it began distributing payments on Friday to over 2,600 Minnesotans.

Just one day after dropping his bid for reelection, Minnesota Gov. Tim Walz said the state's paid family leave program is one of the most transformational bills the state has ever passed.

Roughly 12,000 Minnesotans have already applied for the state's new paid family leave program, according to an update by the Department of Employment and Economic Development.

It's a beauty technique that's exploding. Depending on your age, you might not have heard of it. It's called micro-needling.

The clock is ticking to snag a few more gifts and prepare for that holiday trip to visit family. As the pressure builds, so does the stress.

Here is everything you need to know about how to watch and stream the 2026 Golden Globes.

Bob Weir wrote or co-wrote and sang lead vocals on Grateful Dead classics including "Sugar Magnolia," "One More Saturday Night" and "Mexicali Blues."

Here are the significant books, films and characters joining the list of works in the public domain on Jan. 1, 2026.

Isiah Whitlock Jr. is perhaps best known for his role as state Sen. R. Clayton "Clay" Davis on HBO's "The Wire."

The band announced Perry Bamonte's death on their official website on Friday.

With Eric Ramsay gone, on Monday the Minnesota United announced they have promoted former assistant Cameron Knowles to be their new head coach. It coincided with the first day of training camp.

Jesper Bratt and Ondrej Palat each scored twice and the New Jersey Devils beat the Minnesota Wild 5-2 to snap a four-game skid.

The UDA College Nationals, dubbed "the Super Bowl of dance," is this weekend in Orlando. And for the second year in a row, WCCO has exclusive coverage of the competition, which features the University of Minnesota's dance team.

Best of the Best showcase brings together college and high school dance teams from Minnesota and neighboring states to celebrate the sport, but also debut routines ready for UDA College Nationals in Orlando, Florida.

Anthony Edwards banked in a go-ahead, 3-foot runner with 16.8 seconds and the Minnesota Timberwolves overcame a 19-point deficit to beat the San Antonio Spurs 104-103 on Sunday night.

The shooting death of Renee Good by an ICE agent has raised several legal questions.

The fatal shooting of Renee Good by an ICE agent has raised many legal questions. Constitutional law professor David Schultz, who has taught a class on police, criminal and civil procedure, has some answers.

The DFL race pits two prominent party leaders, Lt. Gov. Peggy Flanagan and Rep. Angie Craig, against each other.

Minnesota Congresswoman Ilhan Omar is calling for answers about the immigration crackdown in the Twin Cities. She is also denouncing the president's attacks on the Somali community and herself. In Talking Points, Esme Murphy shows us how, for Omar, this is a familiar position to be in.

Minnesota Congresswoman Ilhan Omar is calling for clarity about the immigration crackdown in the Twin Cities.

On Dec. 9, 1965, "A Charlie Brown Christmas" debuted on CBS, and it became an instant classic. Lee Jenkins' home is proof that the show is still a hit six decades later.

Holiday lights are on full display across the state right now, and just south of the Twin Cities you'll find a Christmas light show that's been around for more than half a century.

The story begins years ago when the city acquired one of the T-38 Talon Thunderbird jets from the Air Force.

The holidays are upon us, and in the town of Kellogg, Minnesota, you'll find a toy store unlike any other.

With the holidays fast approaching, and lutefisk on the menu for many families, one Minnesota town has the distinction of being called the "Lutefisk Capital of the Country."

ICE is making arrests in Minnesota right next to shoppers grabbing groceries. The tense encounters are happening at places like Target, Walmart and other private businesses.

It's a question many people have been asking: What is the cost of the U.S. Immigration and Customs Enforcement operation in Minnesota? WCCO was able to get some numbers.

It's a business model picking up steam across the Twin Cities. For instance, all the major sports venues in town, like Target Field and U.S. Bank Stadium, no longer accept cash.

From the frozen ponds and lakes to the packed indoor rinks serving as community hubs, hockey is uniquely celebrated and cherished in Minnesota like no other state in the country.

Have you ever wondered how the actors memorize so many lines? A neurologist says everyone could strengthen their memories by taking cues from actors.

Minnesotans got a great view of the northern lights Tuesday night.

A look at the newest addition to the polar bear population at St. Paul, Minnesota's Como Zoo.

From food shelves to school programs, our team is proud to serve where it matters most.

The Minnesota State Fair has unveiled its new food, drinks and vendors for 2025.

A suspect was taken into custody after an attack on Pearl Street Mall in Boulder on June 1 in which there were 15 people and a dog who were victims. The suspect threw Molotov cocktails that burned some of the victims, who were part of a march for Israeli hostages.

NEXT Weather Meteorologist Chris Shaffer says northeast Minnesota could see freezing rain or light snow early on Tuesday. Temperatures in the Twin Cities will hit 40 degrees by the afternoon.

In Minnesota, weather can be all over the place. Here at WCCO, we want to give you what you need to prepare for what's happening next.

WCCO meteorologist Chris Shaffer says a light band of rain showers will pass overnight but it'll stay mild.

A light band of rain showers will pass over the Twin Cities overnight Tuesday, says NEXT Weather meteorologist Chris Shaffer.

We get one more warm day tomorrow with highs near 40. The wind will pick up ushering in much colder air going forward, WCCO meteorologist Mike Augustyniak reports.

The Minnesota United announced they promoted former assistant Cameron Knowles to be their new head coach on Monday, coinciding with the first day of training camp. The announcement comes a day after the departure of Eric Ramsay. Ren Clayton reports.

NEXT Weather Meteorologist Chris Shaffer says northeast Minnesota could see freezing rain or light snow early on Tuesday. Temperatures in the Twin Cities will hit 40 degrees by the afternoon.

U.S. Immigration and Customs Enforcement is making arrests in Minnesota right next to shoppers grabbing groceries. Tense encounters are happening at private businesses. That has some people wondering what authority ICE agents have at places of business. WCCO Jeff Wagner gets answers from an immigration lawyer.

A legal battle has begun to try to force out federal agents out of Minnesota. The state, Minneapolis and St. Paul are working together to sue the Trump Administration. The next step could happen as soon as tomorrow. Minnesota is not the first state to fight back against federal enforcement. WCCO's Ashley Grams talked to an expert to find out whether this suit stands a chance.

WCCO meteorologist Chris Shaffer says a light band of rain showers will pass overnight but it'll stay mild.