Colorado TABOR refunds could be as low as $20 next year, $0 the year after that

Colorado residents could see a big drop in TABOR refunds next year as the state continues to grapple with budget shortfalls. State lawmakers were called back for a special session last month to come up with the $750 million needed after Congress approved tax breaks for individuals and businesses that resulted in less revenue for Colorado. Colorado's state tax code mirrors the federal government's tax code.

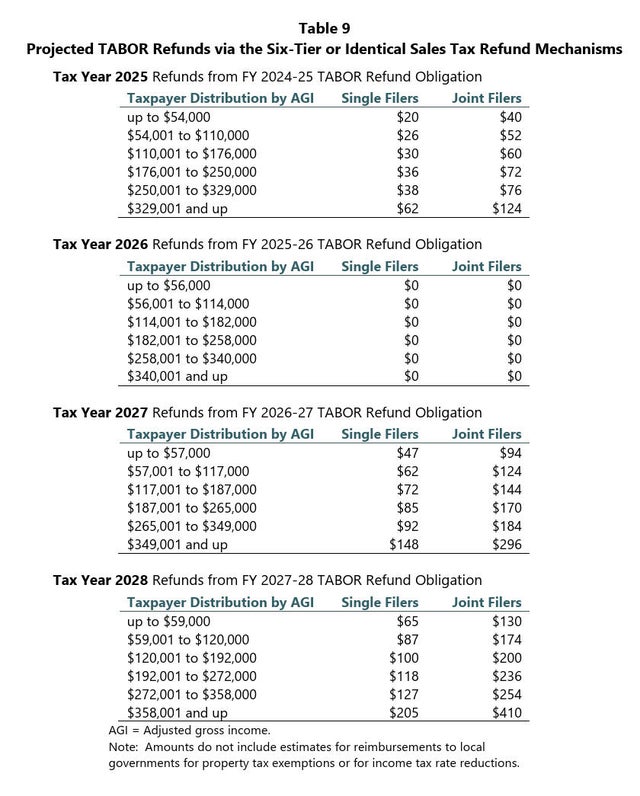

For tax year 2025, refunds from the fiscal year 2024-25 TABOR refund obligation range from just $20 to $62 based on the taxpayer's revenue for single filers and double that amount for joint filers.

For tax year 2026, those refunds drop to $0 for all income levels.

The projection amounts come from the Economic & Revenue Forecast dated September 2025 from Legislative Council Staff, which is labeled as "Nonpartisan Services for Colorado's Legislature" on the document.

The forecast also includes refund projections for tax years 2027 and 2028, with growth projections each year.

Three years ago, the State of Colorado sent out TABOR refund checks of at least $750 to residents.

Additional Information from the Department of Revenue:

About TABOR

The Taxpayer's Bill of Rights (TABOR) Amendment was approved by voters in 1992. The constitutional amendment limits the amount of revenue state and local governments can retain and spend for growth in population and inflation. If governments want to keep money above the cap they need voter approval. Absent voter approval. TABOR also requires voter approval for tax increases.

For more information, please visit Tax.Colorado.gov/TABOR.